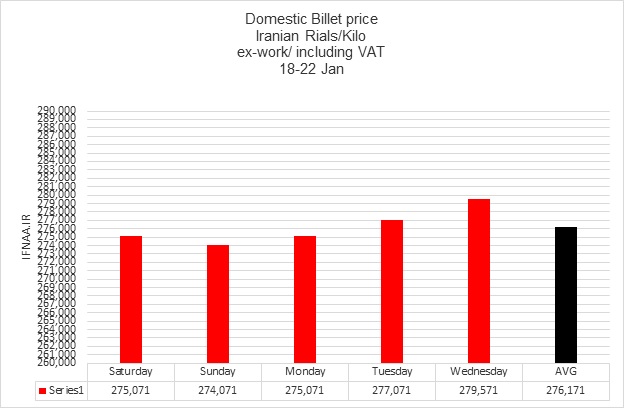

Billet: Supply management and the strengthening of the US dollar boosted billet price during last week in Iran domestic market.

Long Products

Rebar:

Long Products

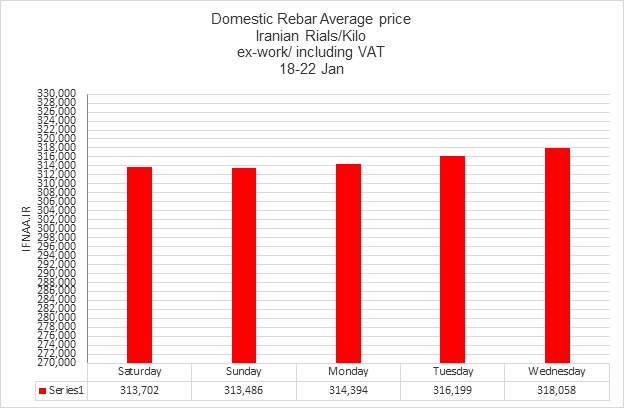

Rebar: Decreased supply and limited billet availability led to higher rebar price.

I-beam:

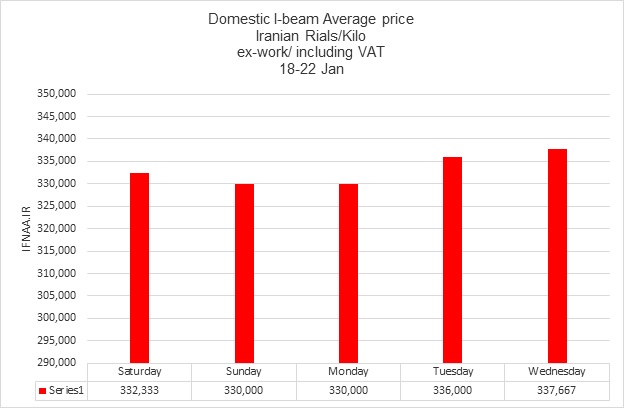

I-beam: Supply management has increased beams price in the market.

Flat Products

HRC:

Flat Products

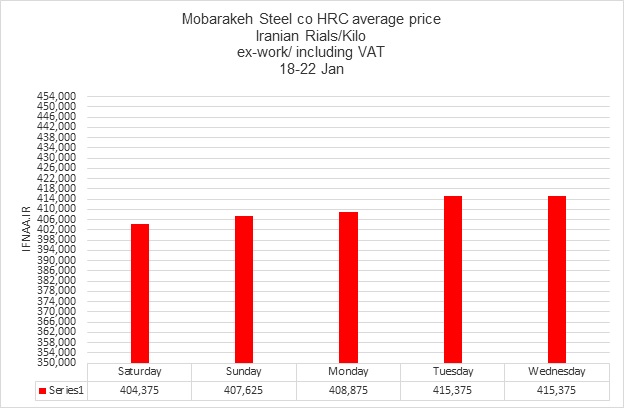

HRC: Rising slab prices coupled with reduced supply have pushed up HRC price. The increase in the exchange rate has contributed to this.

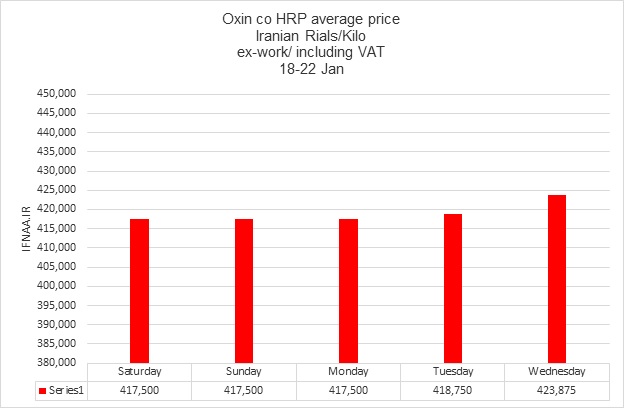

HRP:

HRP: Due to higher ex-rate and improved slab price, Oxin co HRP price increased.

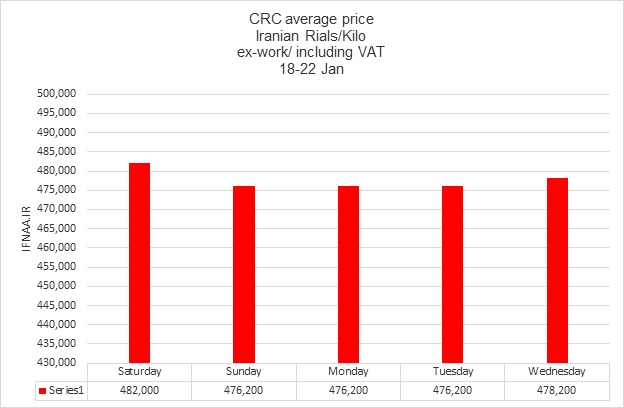

CRC:

CRC: CRC price increased due to a shortage in supply of certain sizes.

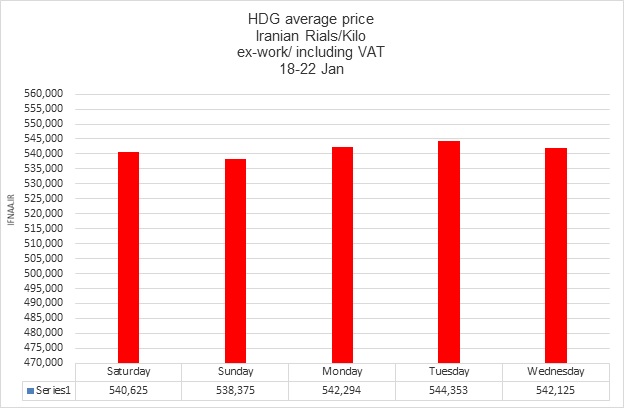

HDG:

HDG: Higher hot-rolled coil price improved HDG price.

Weekly Analysis:

In the world market:

Weekly Analysis:

In the world market: The global market is relatively stable. Iron ore price have increased by USD 5/mt , but billet and scrap have not changed significantly. Demand has not changed yet, but there are reports of reduced production in China. This is because Chinese producers' profit margins have decreased significantly, and there is a possibility of US tariffs, therefore a possible reduction in Chinese exports to the US. Market is expected to continue this trend until February, when the Chinese New Year holiday ends.

In the domestic market: Power and gas outages have significantly impacted steel supply. Weak demand combined with liquidity problems has put pressure on the market. The decrease in billet and slab supply has led to supply constraints, resulting in most mills facing supply issues. A lack of trust has driven capital towards currency and gold. Under these circumstances, the commodity exchange, by linking billet prices to rebar prices, has essentially heated up the rebar market.

CBI average ex-rate for Steel Products (SANA): Rials 662,302/ 1USD

27 Jan 2025

M.Chitsaz

Iran Steel News Bulletin

IFNAA.IR

IRSTEEL.COM